The term ‘Know Your Customer’ (KYC) has become the cornerstone of financial security and financial regulations. Moreover, understanding your customer isn’t just good business sense – it’s a regulatory necessity, deeply intertwined with risk management in finance.

As a guiding force in the finance sector, KYC regulation plays a pivotal role, ensuring that the industry remains both secure and trustworthy, enabling the integrity of financial institutions worldwide.

In this light, let’s dive into the importance of KYC in finance, its technological implications, and how we can leverage these exciting developments in fintech security solutions and software projects.

The Why: Understanding KYC’s Significance

First things first, why is KYC such a big deal?

In essence, KYC regulations are a set of mandatory checks that financial institutions must perform to verify the identity of their clients, aligning closely with practices of customer due diligence. This process helps prevent money laundering, terrorism financing, and other illegal activities.

But it’s not just about ticking boxes; KYC is fundamentally about building trust. By ensuring that financial institutions know who they are dealing with, KYC fosters a safer financial environment for everyone.

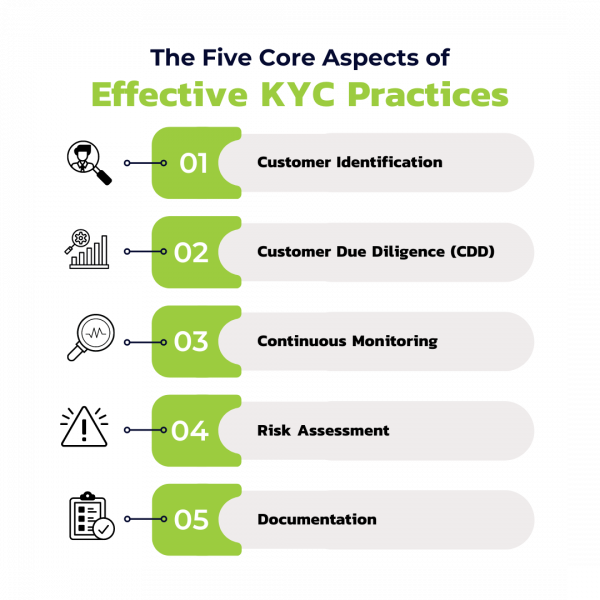

The Five Core Aspects of Effective KYC Practices

- Customer Identification: This is where KYC begins, involving verifying the customer’s identity with reliable data or documents. From checking passports for individual clients to examining business licenses for corporate entities, this step aims to eliminate identity fraud risks.

- Customer Due Diligence (CDD): CDD digs deeper, assessing the customer’s risk profile and understanding their activities. Enhanced due diligence is vital for high-risk clients, involving more thorough examinations of their financial activities and source of funds.

- Continuous Monitoring: Effective KYC demands ongoing vigilance. Monitoring the customer’s transactions and behavior is crucial for detecting any changes that might indicate a risk of illicit activities.

- Risk Assessment: Evaluating potential risks associated with a customer is key. Using tools like predictive models and customer scoring, institutions can inform their risk management strategies effectively.

- Documentation: Every step, from identification to risk assessment, must be meticulously documented. This serves as compliance proof and aids in customer history reviews or audits.

The Compliance Labyrinth

Complying with KYC regulations can feel like navigating a complex maze.

Each country has its own set of rules, and these can change faster than you can say ‘regulatory compliance.’ For financial institutions, staying on top of these changes is no small feat. It requires a keen understanding of both local and international laws – a daunting task but utterly essential.

Technology: A Catalyst in KYC Practices

Technology, particularly automated enterprise risk management solutions, plays a significant role in modern KYC practices. These tools streamline the process, enhance accuracy, and reduce the time spent on manual checks. We are involved in implementing these tech-driven solutions, bringing efficiency and precision to our clients’ KYC processes.

The AI Advantage

Artificial Intelligence (AI) is at the heart of this technological revolution, as AI algorithms can analyze vast amounts of data, spotting patterns and red flags that might indicate fraudulent activity.

This not only speeds up the verification process but also makes it more robust. Plus, AI can continuously learn and adapt, ensuring that the systems stay ahead of the curve in identifying and mitigating risks.

Blockchain: A Secure Backbone

Blockchain technology, with its decentralized and tamper-proof nature, offers another layer of security. By storing customer data on a blockchain, financial institutions can ensure that the information is secure and unalterable.

This not only enhances trust but also provides a transparent audit trail, which is crucial for regulatory compliance.

Implementing Tailored KYC Practices

Implementing KYC is not a one-size-fits-all process. Financial institutions must consider their unique client base, risk tolerance, and regulatory environment.

This is where Aleron IT’s expertise becomes invaluable. We provide tailored solutions that align with your specific needs, ensuring that your institution is not only compliant but also agile in adapting to new trends and risks in digital banking.

The Road Ahead: Navigating KYC in the Financial Sector

The importance of KYC in financial institutions cannot be overstated. It’s a strategic tool that fortifies institutional integrity, facilitates regulatory compliance, and nurtures trust with clients.

As the financial sector continues to evolve, institutions must be prepared to adapt their KYC processes, ensuring they remain robust against emerging risks.

The Human Touch

Despite the technological strides, the human element remains irreplaceable. Technology is a powerful tool, but it needs human intelligence and intuition to guide it.

Professionals in the financial sector must have a deep understanding of both the technology and the regulatory landscape to make the most of these advancements.

Aleron IT: Your Partner in KYC Compliance and Innovation

One thing is clear: KYC will continue to be a vital part of the financial landscape. With technologies like AI and blockchain evolving rapidly, the potential for innovation in this space is immense. We are committed to staying at the forefront of these developments, helping our clients not just meet but exceed their compliance requirements.

Our expertise in fintech is about integrating them seamlessly into financial regulation. We understand that the key to effective KYC compliance lies in balancing technological advancements with deep regulatory knowledge.

Our solutions are designed to help you navigate these challenges, ensuring your institution remains compliant, secure, and trusted by your clients. Whether it’s implementing cutting-edge technology or adapting to new regulatory landscapes, we are here to guide you every step of the way.

Contact us at Aleron IT for a consultation and discover how we can enhance your KYC compliance strategy with our software solutions.

If you would like to be informed about our opportunities in time, follow us on LinkedIn!